December 18, 2017

- Euro forecasting a huge flip after Week 3.

- It’s warmer, but inherent model problems limit me taking a stand.

- The model is notoriously too warm in the longer term.

- There will be no changes to the January forecast now due to very cold start and uncertainty of the models’ prowess.

- Literally, the model goes from the Raging Bull to a Growling Bear.

- Would be biggest flip since the winter of 1989-90, considering how cold we are likely to get before the flip.

Let me review things, briefly. The 30-day target period started December 7, as it was displaced some from the start of the calendar month. An outbreak is coming for Christmas week that may rival the great outbreak of 1989. That winter disappeared in January and February, but came back. I am saying this to you because while I think we have been way ahead on what this pattern is capable of, I am well aware of what can happen on the other side. Remember, 1933 and 2005 have been mentioned in the same breath as 1995, also. So as soon as I know the MJO will go into the warm phases, I will jump on it.

For now, look at the 850 mb forecast for the week ending December 29 from 6 weeks ago:

.png)

Look at it now:

.png)

The week after, ending January 5, looks like this now:

.png)

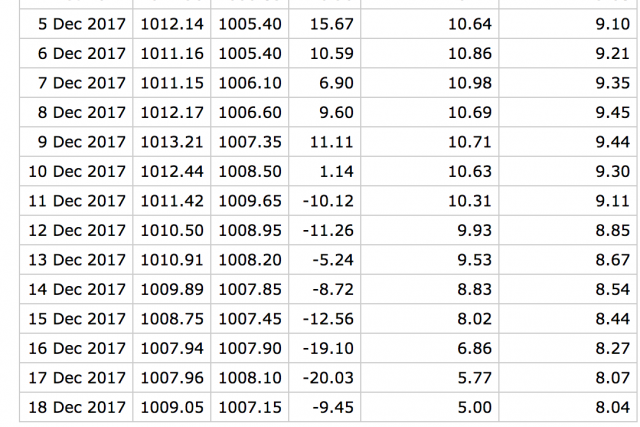

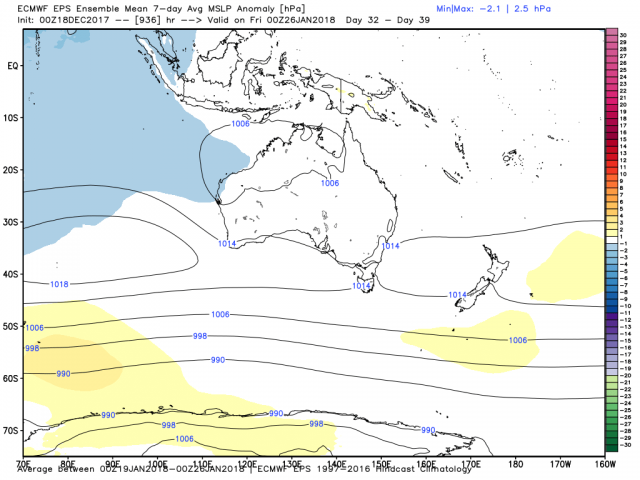

All this being said, there is a big pressure change in the source regions I look at for the MJO. Look at it now:

.png)

There is plenty of low pressure to the east (leading to convergence) and high pressure over Australia, leading to the cattle prod we were waiting for to set this off (the negative SOI):

So we have a fall period against the La Niña positive base state. Through mid and late January, this pressure pattern means the resumption of the positive SOI and would argue for the threat of the warm phases of the MJO developing.

The week ending December 29 at 500 mb:

.png)

The week ending January 5 at 500 mb:

.png)

Then the reversal starts. The week ending January 12:

.png)

This is strange, but we have seen it. In November it actually had the record cold outbreak with it from November 8-14:

The problem is what is going on in eastern Asia and Europe doesn’t jibe with what is going on over the eastern U.S. So I have to ask myself if I simply accept or question the mode. For now I am questioning it.

The week ending January 19 at 500 mb:

.png)

This is a total reversal. The week ending January 26:

.png)

The week ending February 2 at 500 mb:

.png)

That is a cold West and warmer East, but looking like the kind of pattern that sets off what is going on now.

The Verdict

Until January 10, the model has a cold period that I still don’t think is being properly understood (as far as potential). However, it warms the following 3 weeks and the Euro is all in for the threat of the kind of January flip that occurred in 1934, 1990 and 2005, and on par with what happened last year. This is baffling given that this year by January 10 will have what cold there is centered farther to the east and a completely different SST pattern. The bottom line is there will be a warm up coming, but I can’t simply say the models are right, given their performance so far. I am on board with a backing off of the cold that is going to do better than what conventional wisdom of model interpretation had last week.